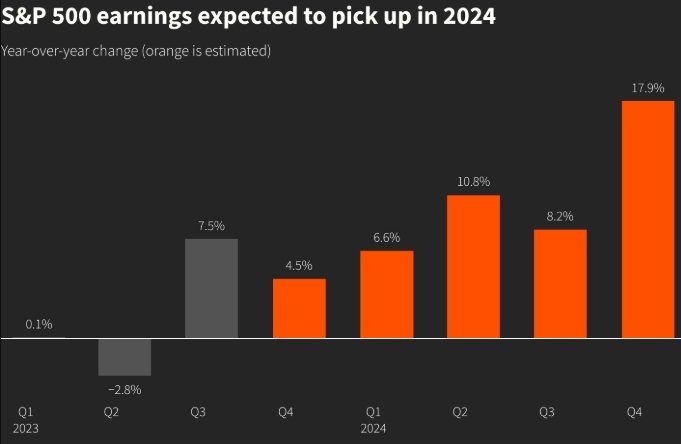

If you’ve glanced at a stock ticker lately, you’ve probably seen the headlines — the S&P 500 and Nasdaq both closed at all-time highs last week. Feels like big news, right? But if you’re not already playing the market, what does this record run actually mean for your wallet?

Good News for Those Already In

Larry Jones, a seasoned investment adviser, says this surge is welcome for anyone with money in the market — think 401(k)s, IRAs, or even that small brokerage account you opened years ago.

“These highs benefit people who are already invested,” Jones explained. “It’s the reward for staying in the game.” After all, higher index levels often translate into better returns and healthier portfolios. If you’ve been riding the waves for the past few years, you’re probably grinning at your latest statement.

One sentence: That said, your grocery bill probably won’t get cheaper anytime soon.

Rising Markets Don’t Help Everyone

While the Wall Street records sound flashy, folks not invested might be left wondering what the fuss is about. Jones puts it bluntly — the highs won’t do much for your day-to-day costs.

“Someone who doesn’t have any investments will still feel it more at the pump or the grocery store,” he said. Inflation, food prices, and travel costs eat into budgets way more than a stock chart ever will.

One local retiree, Sharon McKnight, said she’s happy her modest nest egg is up a bit but still worries about eggs and milk. “I love seeing my 401(k) grow,” she said, “but I’d love cheaper groceries even more.”

So, Should You Invest Now?

Here’s where it gets tricky — record highs make the market feel unstoppable, but that’s not always the best time to jump in.

Jones reminds newbies that the golden rule is to buy low, not high. “If you’re just starting out, the market being up shouldn’t push you to throw in your life savings,” he said. Timing is tough, but history shows buying during dips often pays off more than chasing peaks.

He also gives one tried-and-true tip:

-

Keep a diversified portfolio — don’t bet it all on one stock or sector.

Playing the Long Game Still Wins

Younger investors have time on their side. Jones says they should see record highs as a reminder, not a finish line. The real magic happens when you invest steadily over decades.

“Don’t get caught up in trying to get rich quick,” he says. “If you’re in your 20s or 30s, these record highs are just one chapter in a story that could last 30, 40, 50 years.”

One sentence: Slow and steady still beats fast and reckless.

Tariffs and Other Speed Bumps Ahead

It’s not all smooth sailing, though. The market might be flexing now, but bumps like tariffs and trade tensions can yank it back down in a hurry.

Jones says uncertainty is part of the deal. “There’s always something — tariffs, elections, interest rates,” he said. The trick is not to panic when the inevitable dip comes.

One local broker even joked that the only thing you can count on is change. And taxes.

The Bigger Picture for Main Street

While stock records grab headlines, they’re no cure-all for bigger economic worries. Wage stagnation, rising living costs, and ballooning debt still weigh on many families.

But for those invested — whether you’re just dabbling or living off your dividends — these record closes are worth a small celebration. They’re proof that sticking with it, diversifying, and tuning out the noise can still pay off in the long run.

One sentence: And hey, it might just help your retirement dreams stay alive.